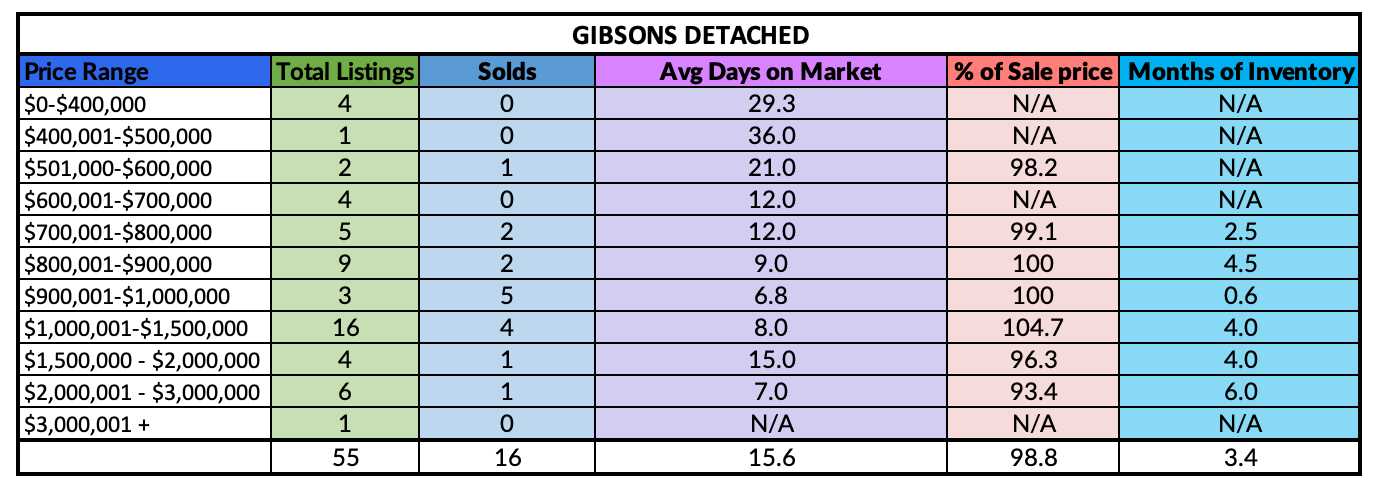

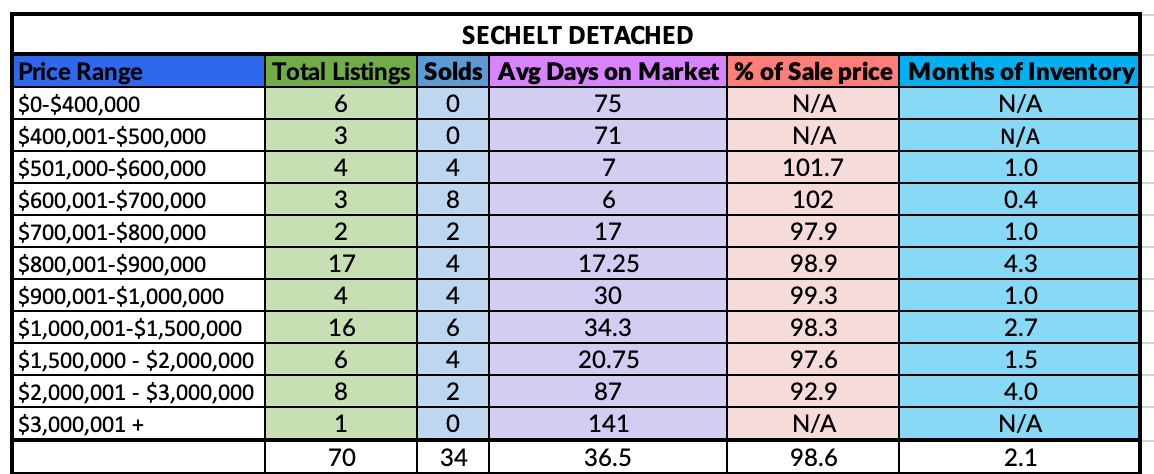

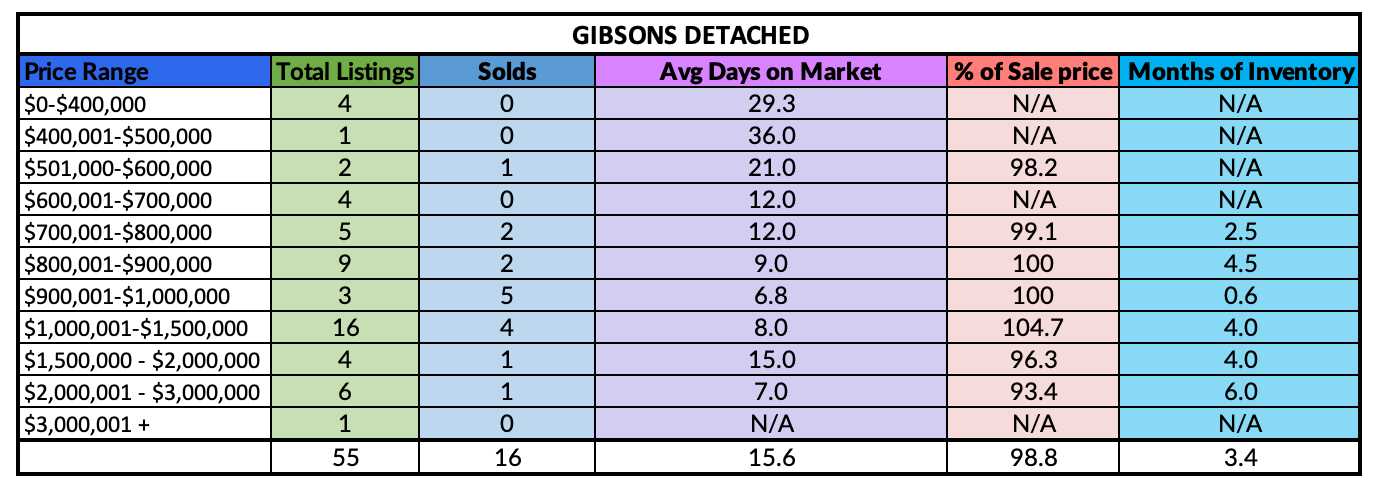

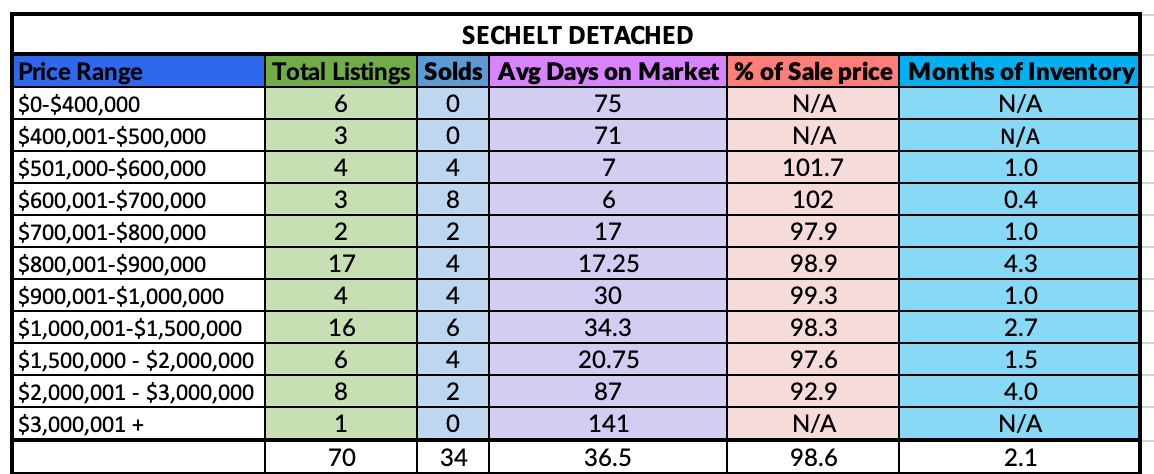

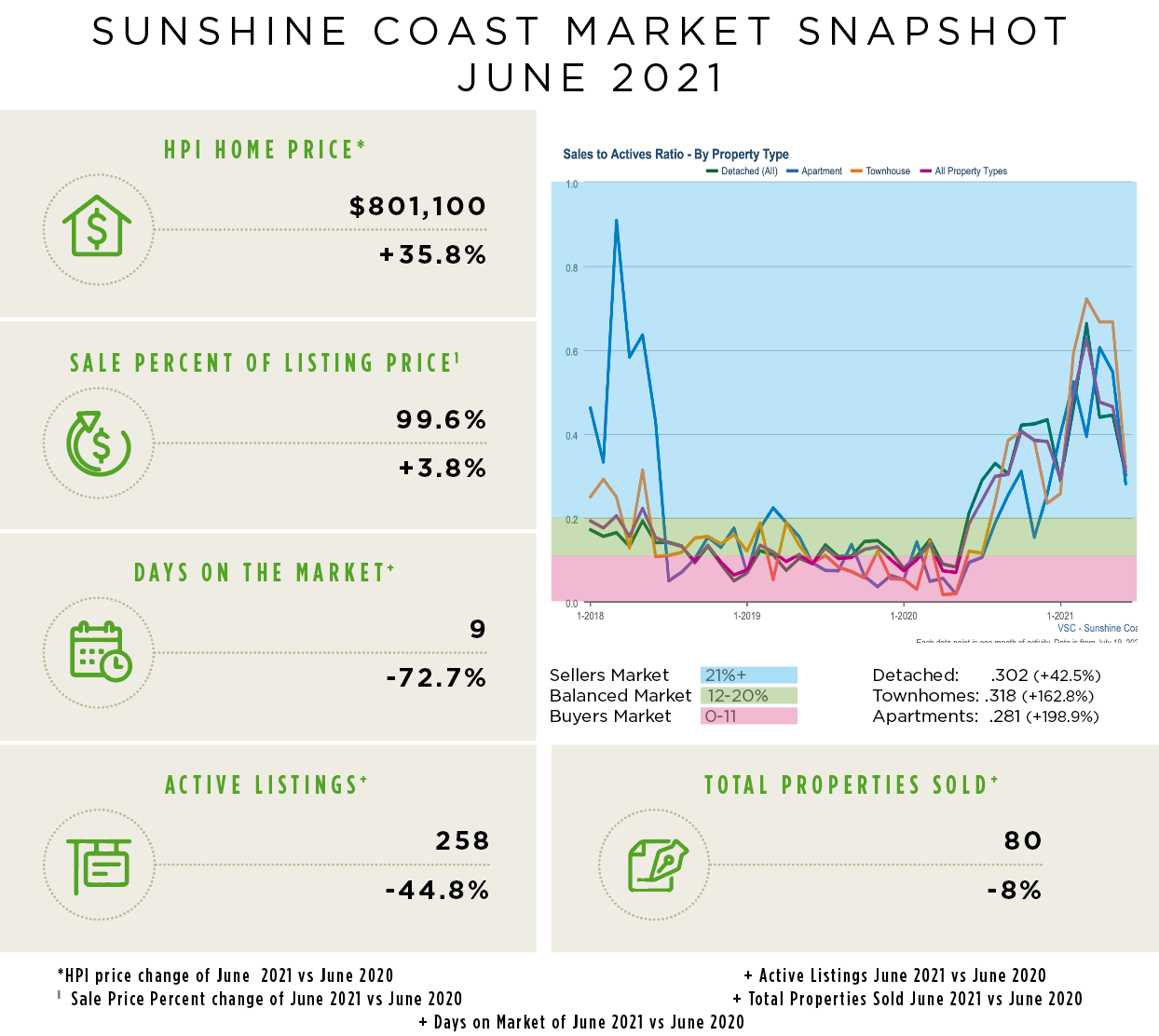

The June market showed some signs of slowing down after 18 months of record breaking sales and prices with the HPI (Housing Price Index) showing a very slight drop to $801,100 from $804,100. As forecasted in our May market report, homes priced from the 800,000's to $1,500,000's took a bit longer to sell last month, except for rare acreages or waterfront property which are still receiving multiple offers. The sale price versus list price gap slightly widened as well from sellers receiving 99.8% of their list price to 99.6%. Lower priced single family homes under $700,000 also generated multiple offers as local buyers and first time home buyers try to seek affordable properties. The strongest indicator of a calmer market is the sales to listing ratio. This shows wether we are in a sellers market or a buyers market and is determined by the amount of sales versus how many homes there are to sell. This showed the most dramatic change with single family homes dropping from .45 to .3, townhomes moving from .67 to .31 and apartments moving from .55 to .28. The sales to listing ratio also indicates how many buyers are in the market versus how many sellers there are. With listings rising and some buyers not able to get into the market due to affordability, we anticipate we will see prices start to level off moving forward into the summer.

To get information about your specific market contact us today.