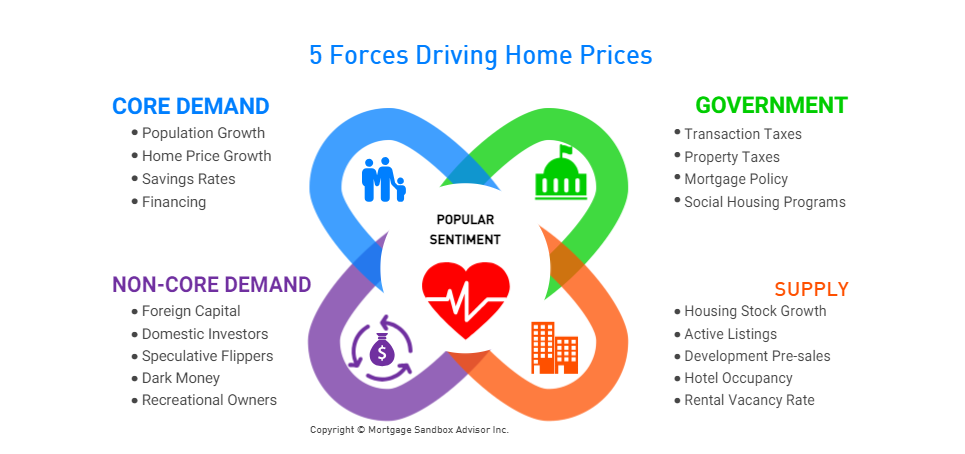

Image from Mortgage Sandbox Advisor. - See link on image for full article and source.

A recent article by Mortgagesandbox outlines five key forces influencing British Columbia's real estate market: population growth, housing supply, government policy, economic conditions, and foreign investment. Population growth, especially in urban areas, drives demand, while housing supply struggles to keep up, leading to price increases. Government policies, including taxation and regulation, impact affordability. Economic conditions like employment rates and wages influence buyer capacity. Finally, foreign investment, particularly from Asia, adds pressure to the market. These factors show that overall Core and non-core demand are much weaker than in the past, putting downward pressure on prices, while shifting demand to townhomes and condos due to smaller budgets. To read the full article CLICK HERE

Local Impact: Sunshine Coast Pricing Pressures

Locally, these forces are playing out in a variety of ways.

Core Demand: Between 2016 and 2021, the Sunshine Coast Regional District (SCRD) experienced a population growth of 7.3%, bringing the population from 29,970 to 32,170. Forecasts estimate the population will grow to 36,587 by 2030, adding roughly 4,400 new residents within the next six years. Given that nearly 69% of households consist of two or fewer people, this could lead to a demand for around 3,000 new homes, with a focus on smaller housing options. New developments are planned in Gibsons and Sechelt, but constraints on water and sewage services may slow down approvals, potentially straining the housing supply.

Local Government Policies: There has been new legislation that has reduced short-term rentals in various ways across the coast which limits property investment opportunities. Additionally, high property taxes in areas like Sechelt are straining affordability.

Provincial Government Policies: Stricter rules favoring tenants, including restrictions on rent increases (which are now capped below inflation), have discouraged some homeowners from renting long-term. As a result, many homeowners opt to sell rather than rent out their properties.

High Interest Rates and Inflation: Rising interest rates and inflation have eroded the purchasing power of both full-time residents and vacation homeowners. Buyers are now stretching their budgets further, often unable to afford the homes they once could. In addition, high inflation has also increased the cost of everyday goods and services, making it even more challenging for residents to invest in real estate.

High Inventory Levels: The Sunshine Coast has seen a significant rise in housing supply. with over 555 homes available, the highest level of homes for sale in nearly 10 years.

Opportunities for Foreign and Non-Local Buyers: The Sunshine Coast remains an attractive market for certain buyers. Unlike other regions in British Columbia, the Sunshine Coast does not have an empty home tax or a foreign buyer tax. This makes the area a more appealing option for foreign buyers and those with secondary or vacation properties, who are otherwise facing additional costs in places like Vancouver.

Short-to-Mid Term Outlook

In the short to mid-term, all of these factors combined—government policies, high interest rates, inflation, and increased housing inventory—are expected to keep prices down. The combination of limited buyer capacity and high inventory means sellers will continue to feel pressure to reduce asking prices to sell their properties.

Long-Term Investment Potential

However, as interest rates start to decline and inflation stabilizes, market conditions could shift. If new developments in key areas like Gibsons and Sechelt are delayed due to constraints on infrastructure (such as water and sewage services), the limited housing supply could lead to increased demand. In the long term, this will likely result in a rebound in property values, making the Sunshine Coast a sound investment opportunity for those who buy during this current market

Local Impact: Sunshine Coast Pricing Pressures

Locally, these forces are playing out in a variety of ways.

Core Demand: Between 2016 and 2021, the Sunshine Coast Regional District (SCRD) experienced a population growth of 7.3%, bringing the population from 29,970 to 32,170. Forecasts estimate the population will grow to 36,587 by 2030, adding roughly 4,400 new residents within the next six years. Given that nearly 69% of households consist of two or fewer people, this could lead to a demand for around 3,000 new homes, with a focus on smaller housing options. New developments are planned in Gibsons and Sechelt, but constraints on water and sewage services may slow down approvals, potentially straining the housing supply.

Local Government Policies: There has been new legislation that has reduced short-term rentals in various ways across the coast which limits property investment opportunities. Additionally, high property taxes in areas like Sechelt are straining affordability.

Provincial Government Policies: Stricter rules favoring tenants, including restrictions on rent increases (which are now capped below inflation), have discouraged some homeowners from renting long-term. As a result, many homeowners opt to sell rather than rent out their properties.

High Interest Rates and Inflation: Rising interest rates and inflation have eroded the purchasing power of both full-time residents and vacation homeowners. Buyers are now stretching their budgets further, often unable to afford the homes they once could. In addition, high inflation has also increased the cost of everyday goods and services, making it even more challenging for residents to invest in real estate.

High Inventory Levels: The Sunshine Coast has seen a significant rise in housing supply. with over 555 homes available, the highest level of homes for sale in nearly 10 years.

Opportunities for Foreign and Non-Local Buyers: The Sunshine Coast remains an attractive market for certain buyers. Unlike other regions in British Columbia, the Sunshine Coast does not have an empty home tax or a foreign buyer tax. This makes the area a more appealing option for foreign buyers and those with secondary or vacation properties, who are otherwise facing additional costs in places like Vancouver.

Short-to-Mid Term Outlook

In the short to mid-term, all of these factors combined—government policies, high interest rates, inflation, and increased housing inventory—are expected to keep prices down. The combination of limited buyer capacity and high inventory means sellers will continue to feel pressure to reduce asking prices to sell their properties.

Long-Term Investment Potential

However, as interest rates start to decline and inflation stabilizes, market conditions could shift. If new developments in key areas like Gibsons and Sechelt are delayed due to constraints on infrastructure (such as water and sewage services), the limited housing supply could lead to increased demand. In the long term, this will likely result in a rebound in property values, making the Sunshine Coast a sound investment opportunity for those who buy during this current market